Many marketers believe that both the strategies of gaining more customers, increasing market penetration or customer acquisition, and selling more to existing customers, retention or loyalty strategy, are equally good. However, the loyalty strategy is often the chosen route due to the cost of acquiring new customers.

You’ve probably heard it before, “it costs 5x more to acquire a new customer than it does to retain an existing one”, but is this still true? Was it ever true?

The true cost of retention strategy

To get right to the point, no, it’s not true. When Dr. Byron Sharp looked into it, there was no hard evidence to back these claims, yet the statistic is not wrong in its entirety. Acquiring customers can be expensive, but if nurturing existing customers is your key strategy, then it will cost your business a lot more. In fact, according to the B2B Institute, when B2C campaigns choose to focus on brand loyalty, they under-perform on every business metric.

Funded by LinkedIn, the B2B Institute is a think tank researching what the future might hold for B2B marketing and decision making.

Recent research from the institute references Dr. Sharp’s work and shows that this age-old saying about acquiring new customers might not be all it’s cracked up to be. Rather, customer acquisition strategies tend to be more effective than loyalty strategies in B2B. But, if that’s true, why do over 64% of B2B marketers still believe that businesses grow by increasing customer loyalty?

It all goes back to two statements deemed as “common knowledge”:

- It’s 5 times more expensive to acquire a new customer than to retain a current one

- If you can reduce churn just 5%, you can grow profits 60-80%

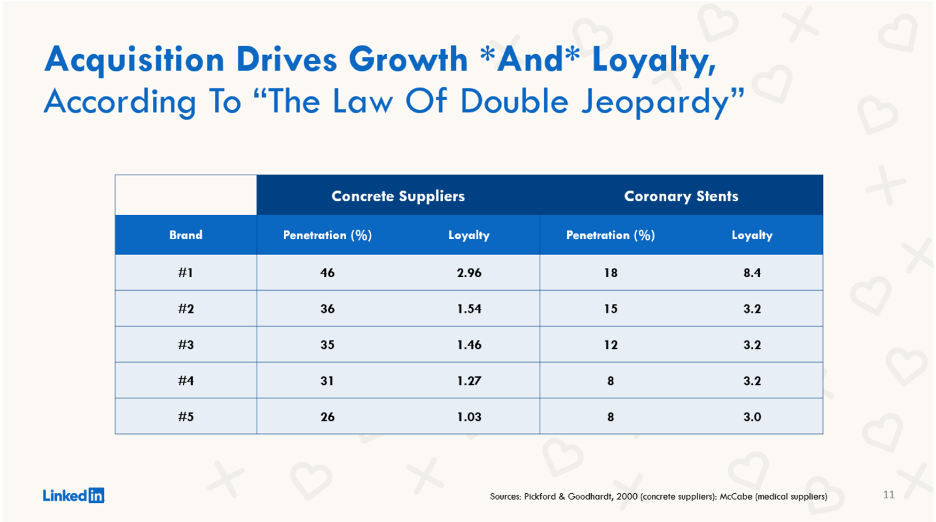

These bits of “common” business knowledge produce millions of Google research and were even taught during my education. Therefore, loyalty must be the way. Yet, data shows that few companies have low market penetration and high loyalty.

That’s not to say that you should throw customer loyalty out the window. In fact, you need to find the right balance between short-term sales activation (which often falls under customer acquisition tactics) and long-term brand building. According to the B2B Institute, this balance is 46% brand building and 54% activation.

The problem is that many people in the world of B2B believe that branding activities only work on irrational consumers, when in reality, by participating in advertising and other acquisition techniques, you are working to increase the proportion of adopters who will make the leap and adopt your product or service on their own. Therefore, if you want the benefits of loyalty, then your company needs to focus on market penetration, because with market penetration comes all the benefits that we associate with loyal consumers.

In the world of personalized, 1:1 service, you might think that loyalty strategies would work better in B2B, but once again, current research suggests that B2B might be more like B2C than you think.

But B2B and B2C are different?

While B2B and B2C are often regarded as two fairly different groups, they relate more than some think and can often learn a thing or two from one another. Recently, I performed a case study on a B2C company and its brand under the context of the question: does brand loyalty still exist today, and does it really matter?

The conclusion? Yes, it still exists, but no, it doesn’t really matter. This statement may come as a surprise to you. It did to me. Think about how many times you’ve taken that stamp card at the coffee shop, signed up to get airline miles, or given a company your email address to get a discount. If you’ve done any of these things, then you’ve participated in or signed up for a company’s loyalty program. So, of course you’d think that retention and loyalty work best since they worked on you!

Yet, the case study showed that many of the customers interviewed were first time visitors to the business. How is this related you might ask? Well, it means that the brand likely wasn’t pursuing a loyalty or retention strategy. In fact, when asked, the brand’s team explicitly told me that they don’t target a particular group.

Although there was a clear target market for this company, those who might initially appear to be outside of this market still ended up becoming paying customers. Had the company decided to only focus on one target group or to only nurture existing consumers, it would have missed out on entire groups of customers!

While the company in question didn’t follow the precise split suggested by the B2B Institute, it did use reach strategies to communicate both with buyers and non-buyers. In this approach, a company doesn’t intentionally address one audience over another, but rather addresses everyone because everyone has potential. According to the B2B Institute, these types of reach strategies tend to not only be the most effective, but could also be better, in general, than tight targeting.

Start using your voice

If you’ve followed our blog for some time, then you have definitely heard us talk about voice. Whether it’s Voice of Company, Voice of Industry, or Voice of Customer , all play an important role in B2B marketing. But now, the B2B Institute brings in another aspect of voice that is equally as, if not more, important: Share of Voice (SOV).

If you’re unfamiliar with SOV, it is typically defined as a company’s share of all category advertising expenditure and tends to have a positive relationship with rate of growth. This “rule” about setting your SOV over your Share of Market (SOM) has been around for over 50 years and still holds true in B2C today. In addition, early market research suggests that B2B tends to react to SOV in the same was the B2C does.

One of the core ideas to have come out of this new research is that B2B companies could learn a thing or two from B2C. That doesn’t mean that trends like personalization, account-based marketing, and retention should be put completely on the back burner. Instead, B2B needs to learn how to balance this long-term nurturing with traditionally short-term methods in order to expand their customer base and grow.